The Balance Sheet Account That Depreciation Is Recorded To Is

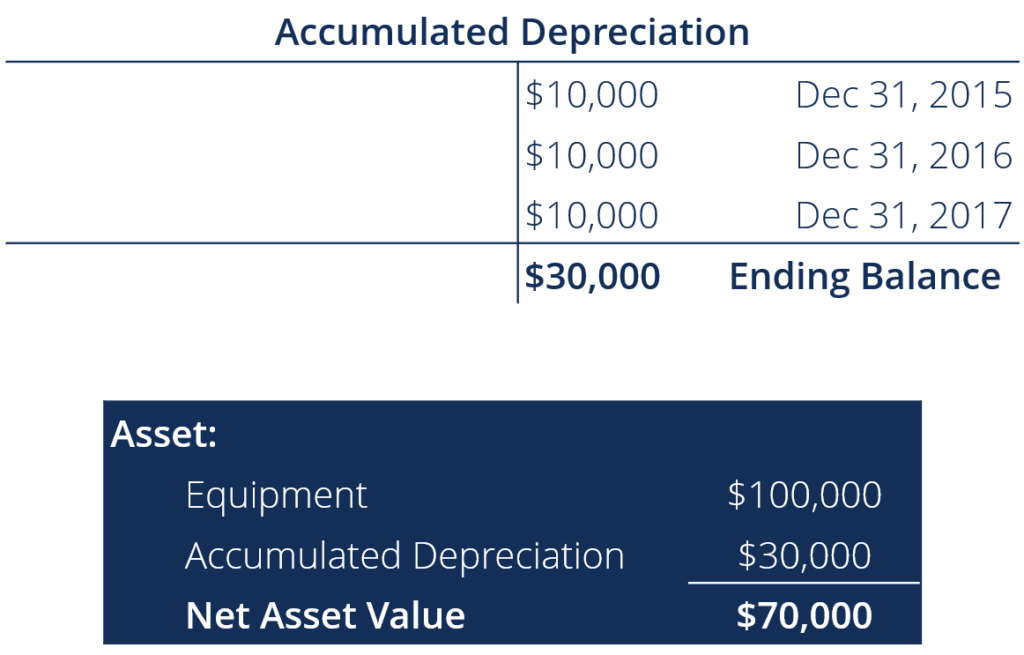

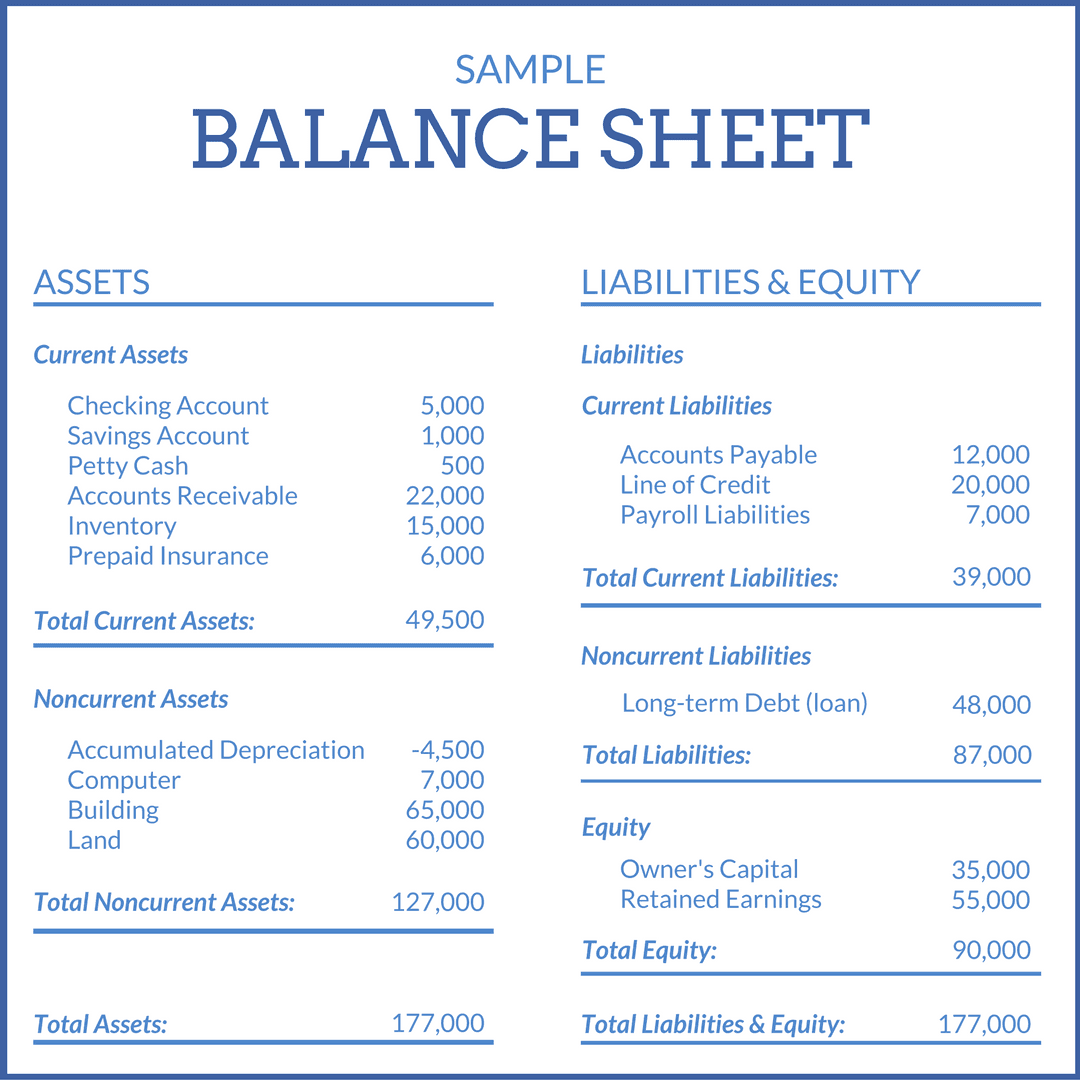

The Balance Sheet Account That Depreciation Is Recorded To Is - It represents a credit balance. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Also, fixed assets are recorded on the balance sheet, and since accumulated. Web the accumulated depreciation account is a contra asset account on a company's balance sheet. Web your balance sheet will record depreciation for all of your fixed assets. Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. It appears as a reduction from the gross amount of fixed. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which.

It appears as a reduction from the gross amount of fixed. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which. Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. Also, fixed assets are recorded on the balance sheet, and since accumulated. Web your balance sheet will record depreciation for all of your fixed assets. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. It represents a credit balance. Web the accumulated depreciation account is a contra asset account on a company's balance sheet.

Web your balance sheet will record depreciation for all of your fixed assets. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which. Also, fixed assets are recorded on the balance sheet, and since accumulated. Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. It represents a credit balance. It appears as a reduction from the gross amount of fixed. Web the accumulated depreciation account is a contra asset account on a company's balance sheet.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. It appears as a reduction from the gross amount of fixed. Web the accumulated depreciation account is a contra asset account on a company's balance sheet. This means you’ll see more overall depreciation on your balance sheet than you will on an income.

template for depreciation worksheet

Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which. It represents a credit balance. It appears as a reduction from the gross amount.

8 ways to calculate depreciation in Excel Journal of Accountancy

Web your balance sheet will record depreciation for all of your fixed assets. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. Also, fixed assets are recorded on the balance sheet, and.

Accumulated Depreciation Definition, Example, Sample

Web the accumulated depreciation account is a contra asset account on a company's balance sheet. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. It appears as a reduction from the gross amount of fixed. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in.

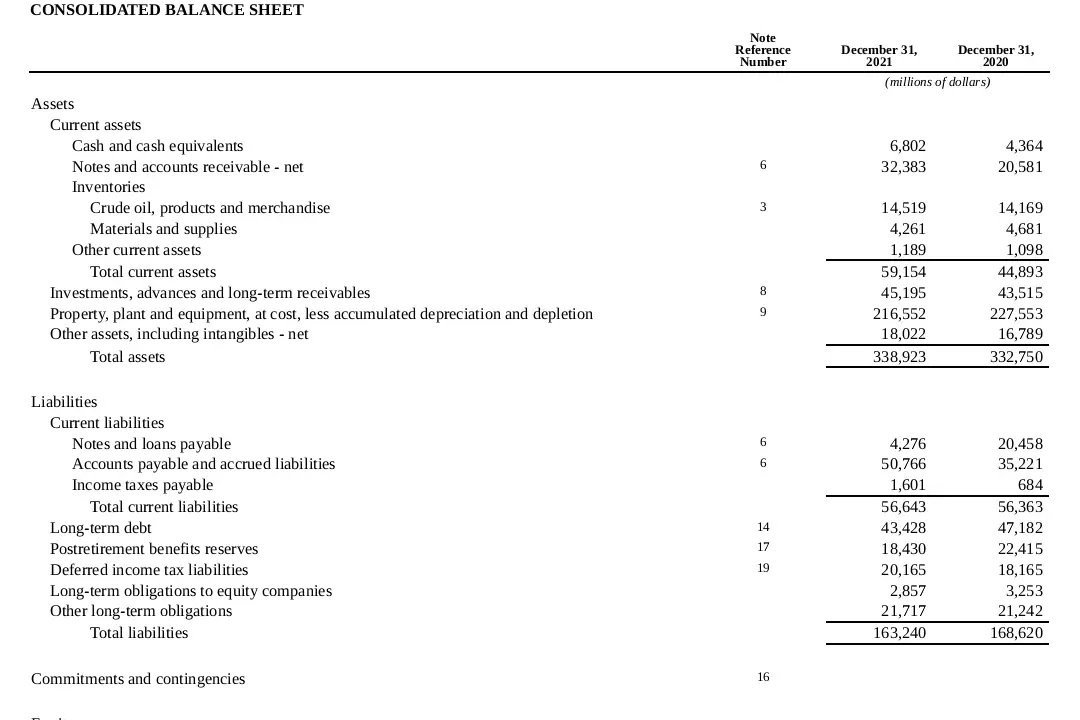

What Is a Financial Statement? Detailed Overview of Main Statements

Web the accumulated depreciation account is a contra asset account on a company's balance sheet. It represents a credit balance. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which. Accumulated depreciation represents the total depreciation of a company's fixed assets at a.

Pourquoi l'amortissement cumulé estil un solde créditeur

This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. It represents a credit balance. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which. Web your balance sheet will record depreciation for all of.

Where is accumulated depreciation on the balance sheet? Financial

Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which. It represents a credit balance. It appears as a reduction from the gross amount of fixed. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time..

Accumulated Depreciation on Balance Sheet Financial

It represents a credit balance. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which. Web the accumulated depreciation account is a contra asset account on a company's balance sheet. Web key takeaways accumulated depreciation is the sum of all recorded depreciation on.

Where is accumulated depreciation on the balance sheet? Financial

Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time. Web your balance sheet will record depreciation for all of your fixed assets. It represents a credit balance. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation.

😍 State the formula for the accounting equation. What Is the Accounting

Web your balance sheet will record depreciation for all of your fixed assets. It appears as a reduction from the gross amount of fixed. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which. It represents a credit balance. Also, fixed assets are.

It Represents A Credit Balance.

Web your balance sheet will record depreciation for all of your fixed assets. Web the accumulated depreciation account is a contra asset account on a company's balance sheet. This means you’ll see more overall depreciation on your balance sheet than you will on an income statement. It appears as a reduction from the gross amount of fixed.

Also, Fixed Assets Are Recorded On The Balance Sheet, And Since Accumulated.

Web key takeaways accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which. Accumulated depreciation represents the total depreciation of a company's fixed assets at a specific point in time.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)